Tourism is a great way to attract foreign currency to a country and build local economies, especially in remote or isolated places. But the catch is finding a way to get people to go the distance and come and visit and spend their money.

In a global South twist on the well-known Ice Hotel in Sweden (www.icehotel.com) – a hotel entirely built out of ice – enterprising Bolivians have built a hotel out of salt.

A Bolivian hotel in the middle of the world’s largest salt flats has found a clever way to attract tourists to this remote holiday destination: build the hotel entirely out of salt, right down to its furniture.

The South American nation is one of the poorest in Latin America, and its income distribution is among the region’s most unequal. Bringing in foreign currency and attracting more tourists can help to reduce this poverty. According to the World Travel and Tourism Council, travel and tourism will contribute 2 percent to the country’s gross domestic product (GDP) in 2011. Around 75,000 jobs are directly dependent on the tourism business in the country and this is projected to rise to 96,000 jobs by 2021.

And it is a good business to be involved in: “Travel and tourism is one of the world’s great industries, providing 9 percent of global GDP and 260 million jobs; it drives economic growth, business relationships and social mobility,” according to David Scowsill, President and CEO of the World Travel and Tourism Council.

The Hotel de Sal Cristal (http://www.hosteldesal.com/?L=2), near Colchani, hosts guests who come to visit the salt flats of Salar de Uyuni (http://en.wikipedia.org/wiki/Salar_de_Uyuni). They are believed to store 50 to 70 percent of the world’s lithium supplies and an economic boom has started in the area. The striking and blinding white salt flats were featured in the James Bond film “Quantum of Solace.”

The hotel’s unique construction from rock-hard salt hewn from the salt flats is working to encourage tourists to stay longer in the area during their holiday. Before, they would just take a quick excursion on to the salt flats before moving on to their next destination.

The Hotel de Sal Cristal is built using blocks of salt cut from the surrounding flats. The architectural design is inspired by the ancient Chinese balancing philosophy of Feng Shui (http://en.wikipedia.org/wiki/Feng_shui). Following the principles of the philosophy, it faces the sun and balances both masculine and feminine energies. Shaped like three coca leaves, the feminine side, this balances with the more masculine side reflected in the salt flats, the hotel’s website claims.

The hotel has 27 rooms with hot water and heating. – and beds made of salt. In the dining room, people can sit on chairs made of salt and eat at salt tables. The rooms are wall-to-wall salt, bright and white.

The hotel’s pool is surrounded by sand-like salt.

The hotel’s ‘Resto-Bar’ offers views of the salt flats and promises it will “allow the cosmic energy…” to flow freely.

The menu offers llama meat and risotto of quinoa (http://en.wikipedia.org/wiki/Quinoa) alongside traditional Bolivian dishes, salads and soups and Bolivian-themed treats.

The hotel has an ‘astronomic observatory’ for star gazing, making the most of the low level of light pollution on the flats.

One of the hotel’s tour guides, Pedro Pablo Michel Rocha from Hidalgo Tours (http://www.salardeuyuni.net/), told the Daily Mail newspaper: “I love it when visitors come to this place for the first time.

“They can’t get over the fact that everything is made out of salt and I’ve even seen a few people lick the furniture to make sure!

“It is a wonderful experience to come somewhere like this where they’ve used the natural materials available to create something like a hotel.”

The salt flats, formed from prehistoric lakes, have a salt crust hard-baked by the sun with a pool of salty water underneath which is rich in the rare element lithium. Lithium (http://en.wikipedia.org/wiki/Lithium) is sought-after for its use in things like re-chargeable batteries for mobile phones, computers and electric cars.

The area’s economy has boomed since 3.4 million tons of lithium – believed to be half the world’s supply – was discovered underneath the salt flats.

The power of tourism to alleviate poverty has been documented by Caroline Ashley, co-author of Tourism and Poverty Reduction: Pathways to Prosperity (http://www.earthscan.co.uk/?TabId=92842&v=497073), after extensive research on tourism’s impact on poverty in countries across Africa andAsia.

She argues that “tourism can fight poverty.”

“Note, we say ‘can’, not that it always does. The share of spending by tourists within a destination that reaches poor people can vary from less than 10 percent to a high of 30 percent,” Ashley told BusinessFightsPoverty (http://www.businessfightspoverty.org).

“When it works, international tourism is actually a very good way of channelling resources from rich to poor. In destinations as diverse as hiking on Mount Kilimanjaro in Tanzania, business tourism in Vietnam and cultural tourism in Ethiopia, between one quarter and one third of all in-country tourist spending accrues to poor households in and around the destination.”

Ashley said a successful tourism strategy needs to focus on “the 4Ps: pay, procurement, persuasion and partnership.”

“Pay a living wage to local employees; take a hard look at procurement and potential to source locally … persuade – or at least inform – your clients how to take up opportunities to spend in the local economy…” and build a partnership with government to integrate tourism into the local economy.

And it looks like the hotel can’t get more connected to the local economy than being made of the very salt that surrounds it.

By David South, Development Challenges, South-South Solutions

Published: November 2011

Development Challenges, South-South Solutions was launched as an e-newsletter in 2006 by UNDP's South-South Cooperation Unit (now the United Nations Office for South-South Cooperation) based in New York, USA. It led on profiling the rise of the global South as an economic powerhouse and was one of the first regular publications to champion the global South's innovators, entrepreneurs, and pioneers. It tracked the key trends that are now so profoundly reshaping how development is seen and done. This includes the rapid take-up of mobile phones and information technology in the global South (as profiled in the first issue of magazine Southern Innovator), the move to becoming a majority urban world, a growing global innovator culture, and the plethora of solutions being developed in the global South to tackle its problems and improve living conditions and boost human development. The success of the e-newsletter led to the launch of the magazine Southern Innovator.

Follow @SouthSouth1

Google Books: https://books.google.co.uk/books?id=rVEU1nWQ5IUC&dq=development+challenges+november+2011&source=gbs_navlinks_s

Slideshare: http://www.slideshare.net/DavidSouth1/development-challengessouthsouthsolutionsnovember2011issue

Southern Innovator Issue 1: https://books.google.co.uk/books?id=Q1O54YSE2BgC&dq=southern+innovator&source=gbs_navlinks_s

Southern Innovator Issue 2: https://books.google.co.uk/books?id=Ty0N969dcssC&dq=southern+innovator&source=gbs_navlinks_s

Southern Innovator Issue 3: https://books.google.co.uk/books?id=AQNt4YmhZagC&dq=southern+innovator&source=gbs_navlinks_s

Southern Innovator Issue 4: https://books.google.co.uk/books?id=9T_n2tA7l4EC&dq=southern+innovator&source=gbs_navlinks_s

Southern Innovator Issue 5: https://books.google.co.uk/books?id=6ILdAgAAQBAJ&dq=southern+innovator&source=gbs_navlinks_s

This work is licensed under a

Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 License.

Wednesday, December 30, 2020 at 3:02AM

Wednesday, December 30, 2020 at 3:02AM

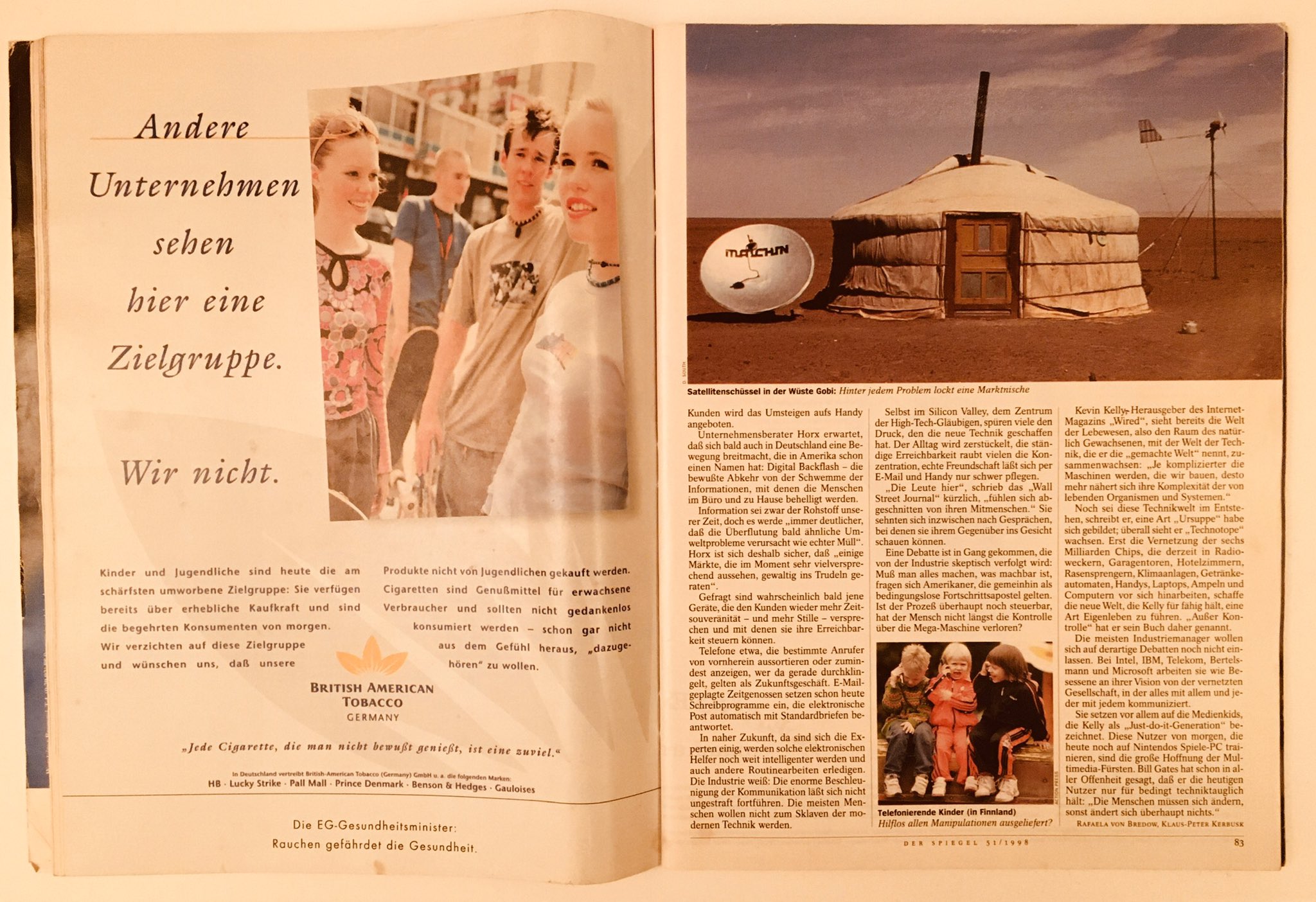

In 1998 Der Spiegel's "Kommunikation total" issue profiled the global connectivity revolution underway and being accelerated by the Internet boom of the late 1990s. It chose my picture of a satellite dish and a ger in the Gobi Desert to symbolise this historic event.

In 1998 Der Spiegel's "Kommunikation total" issue profiled the global connectivity revolution underway and being accelerated by the Internet boom of the late 1990s. It chose my picture of a satellite dish and a ger in the Gobi Desert to symbolise this historic event. 1998,

1998,  David South,

David South,  Douglas Gardner,

Douglas Gardner,  Gobi desert,

Gobi desert,  UNDP,

UNDP,  UNDP Mongolia Communications Office,

UNDP Mongolia Communications Office,  austerity,

austerity,  crisis,

crisis,  poverty,

poverty,  shock therapy,

shock therapy,  transition,

transition,  women in

women in  Agenda 21,

Agenda 21,  Austerity,

Austerity,  Blue Sky Bulletin,

Blue Sky Bulletin,  Data,

Data,  David South Consulting,

David South Consulting,  Environment,

Environment,  Magazine Stories 1990s,

Magazine Stories 1990s,  Northeast Asia,

Northeast Asia,  Poor,

Poor,  Shock Therapy,

Shock Therapy,  Solutions,

Solutions,  Sustainable Development,

Sustainable Development,  Trade,

Trade,  UN Innovator Stories,

UN Innovator Stories,  UNDP,

UNDP,  UNDP Innovator Stories,

UNDP Innovator Stories,  UNDP Mongolia,

UNDP Mongolia,  United Nations,

United Nations,  United Nations Mission,

United Nations Mission,  Women

Women